Investing in the money market can be advantageous for several reasons:

Safety: Money market investments typically involve low-risk securities such as Treasury bills, certificates of deposit (CDs), and commercial paper issued by highly-rated corporations. This makes them relatively safe compared to other investment options.

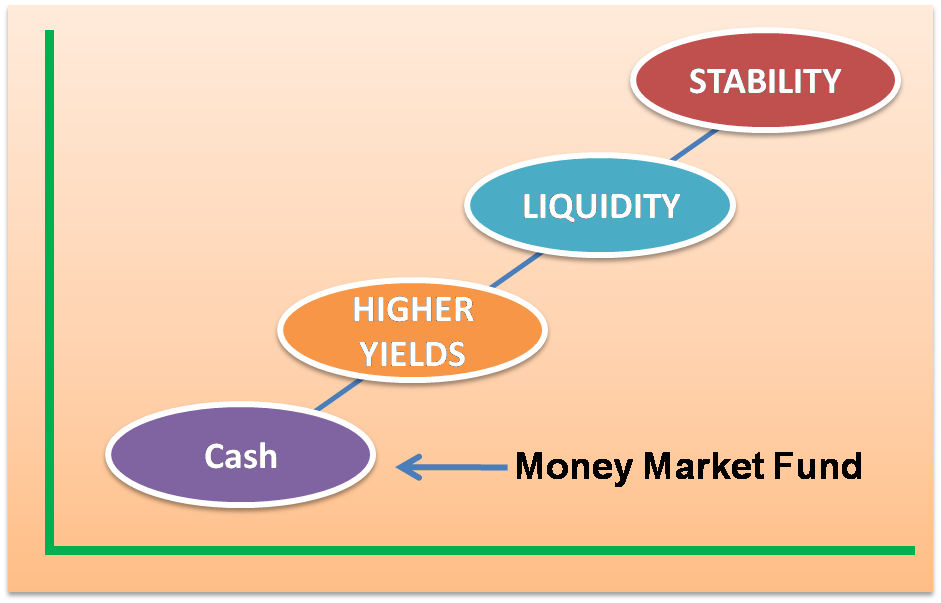

Liquidity: Money market investments are highly liquid, meaning you can easily convert them into cash without significant loss of value. This makes them suitable for short-term financial goals or emergencies.

Stability: Money market investments often provide stable returns compared to more volatile investment options such as stocks or mutual funds. While the returns may be modest, they are generally consistent and predictable.

Diversification: Including money market investments in your portfolio can help diversify risk. They can serve as a stabilizing component alongside more growth-oriented investments, helping to balance out overall portfolio risk.

Short-term Goals: Money market investments are well-suited for short-term financial goals such as saving for a vacation, a down payment on a house, or an emergency fund. They offer a higher return than traditional savings accounts while still maintaining liquidity and safety.

Interest Earnings: Although money market returns are typically lower than those of riskier investments, they still offer the potential to earn interest income. This can help your funds grow over time, albeit at a more moderate pace.

Capital Preservation: For investors prioritizing capital preservation over aggressive growth, money market investments can be an ideal choice. They provide a way to park funds securely while still earning some return.

Overall, investing in the money market can be a prudent strategy for those seeking stability, liquidity, and modest returns on their investments. However, it’s essential to assess your financial goals, risk tolerance, and investment horizon before allocating funds to the money market or any other investment option.