Filing NIL (Non-Individuals) KRA (Kenya Revenue Authority) returns online can be done through the iTax platform.

Here’s a step-by-step guide:

1. **Access the iTax Portal**: Visit the KRA iTax portal website (https://itax.kra.go.ke/). If you don’t have an account, you’ll need to register.

2. **Log in**: Enter your PIN and password to log in to your iTax account.

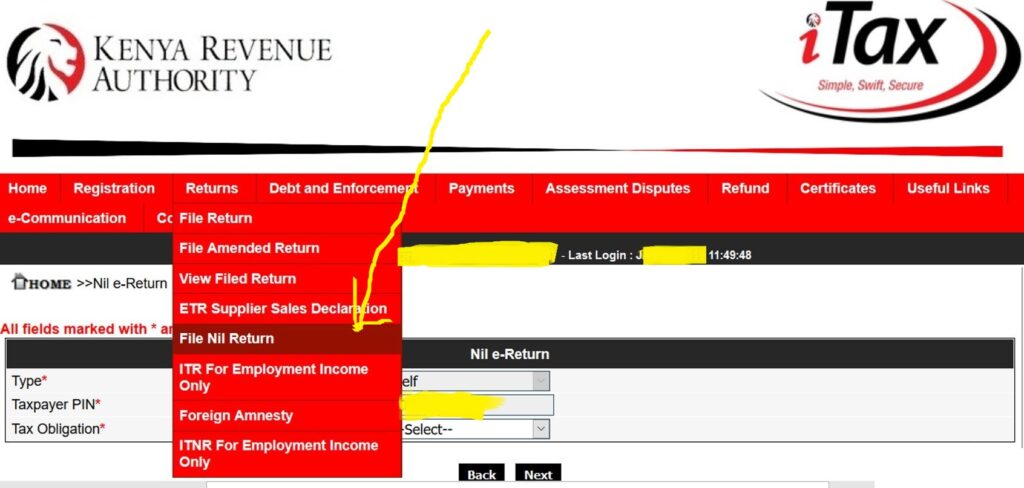

3. **Select ‘Returns’ Tab**: Once logged in, click on the “Returns” tab on the menu bar.

4. **Choose the Tax Obligation**: Under the “Returns” tab, select the relevant tax obligation for which you want to file returns. For NIL returns, select the appropriate tax obligation (e.g., Income Tax, PAYE).

5. **Initiate the Return Filing**: Click on the “File Nil Returns” option. This option allows you to file returns even if you haven’t made any income during the filing period.

6. **Enter Details**: You’ll be prompted to fill in the required details such as your PIN, tax obligation, return period, and other relevant information. Ensure that you enter accurate information.

7. **Confirm Nil Return Filing**: After entering the necessary details, review the information you’ve provided and confirm that you’re filing a NIL return.

8. **Submit**: Once you’ve confirmed all the details are correct, submit the return. You may receive a confirmation message indicating that your NIL return has been successfully filed.

9. **Print Acknowledgment**: After successfully filing your NIL return, it’s advisable to print the acknowledgment receipt for your records. You can do this by clicking on the “Print Acknowledgement Receipt” option.

10. **Logout**: Once you’ve completed the filing process and obtained the acknowledgment receipt, log out of your iTax account for security reasons.

Remember to file your returns within the specified deadlines to avoid penalties or legal consequences. Additionally, ensure that you keep records of all your financial transactions for future reference and auditing purposes.