Filing Kenya Revenue Authority (KRA) returns online is a straightforward process. Here’s a step-by-step guide to help you file your KRA returns online:

1. **Access KRA’s iTax Portal:**

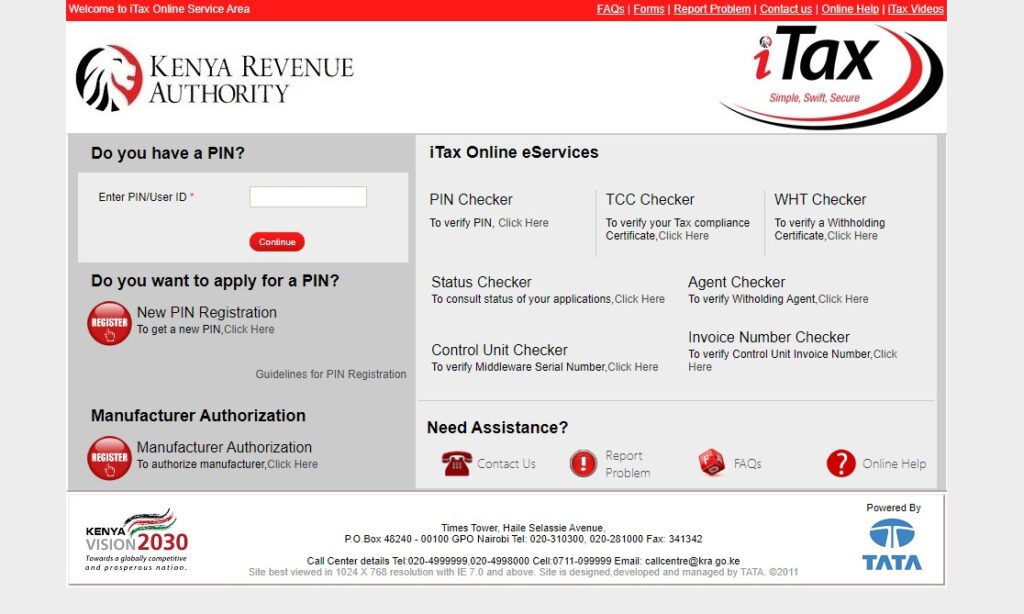

Visit the KRA iTax Portal by typing the URL https://itax.kra.go.ke/ into your web browser’s address bar.

2. **Login or Register:**

If you already have an account, log in using your KRA PIN and password. If you’re new to the platform, click on the “New PIN Registration” link and follow the instructions to register.

3. **Select the Tax Obligation:**

Once logged in, navigate to the “Returns” tab and select the appropriate tax obligation. For most individuals, this will be the “Income Tax Resident Individual” option.

4. **Fill in the Required Details:**

You will be prompted to fill in various details such as your employment income, rental income, business income, and any other applicable income. Make sure to have all necessary documents and information ready.

5. **Validate the Return:**

After filling in all the required details, validate the return to ensure that all the information provided is accurate and correct. Review the return carefully before submission.

6. **Submit the Return:**

Once you’ve validated the return and ensured that all information is accurate, submit the return electronically through the iTax portal.

7. **Receive Acknowledgment:**

After successful submission, you will receive an acknowledgment receipt. This receipt serves as proof that you have filed your returns.

8. **Payment (If Applicable):**

If you have tax due, you will need to make the payment through the provided payment options on the iTax portal. These options usually include mobile money, bank deposit, or electronic funds transfer.

9. **Print Acknowledgment Receipt:**

It’s advisable to print a copy of the acknowledgment receipt for your records.

10. **Keep Records:**

Maintain records of your tax returns and any payments made for future reference or in case of any audit inquiries.

Remember to file your returns before the specified deadline to avoid penalties or fines. The deadline for filing individual tax returns in Kenya is usually on or before June 30th of the following year for employment income and rental income. However, it’s essential to verify the current deadline as it may vary from year to year.